KernelDAO

Traditional finance runs on delays.

Money moves slowly. Credit takes days. Settlement takes longer.

As a result, trillions in capital sit idle. Frozen, waiting for approvals, reconciliations, and batch processes that belong to another era.

The numbers are staggering:

The global payments system moves over $200 trillion every year, yet remains slow, costly, and capital-inefficient.

Nearly $27 trillion sits locked in pre-funded accounts across the system at any moment.

Remittances still average ~6% in fees, despite being one of the most mission-critical flows on the planet.

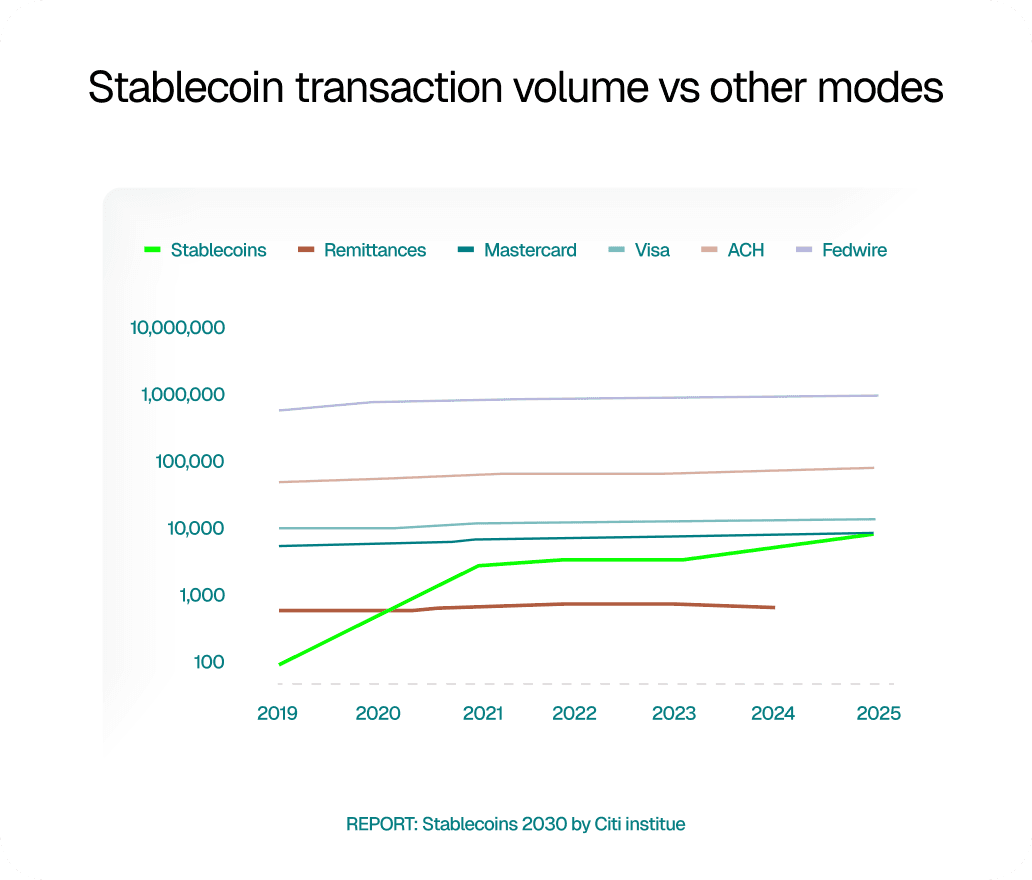

Meanwhile, stablecoins have exploded into a $300B+ market, proving digital dollars can move globally in real time.

Kred believes this should change.

Kred is how it changes.

Kred: The Internet of Credit

A programmable liquidity layer that connects stablecoin deposits to real-world, short-tenor credit demand.

Think of Kred as the invisible engine powering global money movement ensuring liquidity is always available, instantly deployable, and continuously productive.

The Problem: Idle Capital Everywhere

Across the global financial system, capital is stuck in waiting rooms.

It sits as pre-funding.

As collateral.

As buffer.

As float.

Remittance companies must pre-fund corridors.

Fintechs park cash for settlement windows.

Enterprises hold payroll liquidity days in advance.

Card programs lock capital for authorisations.

Trade finance traps cash behind credit checks and documents.

It’s like owning a fleet of trucks but forcing them to idle in a parking lot.

Useful assets become dead weight.

How Kred Transforms Payments

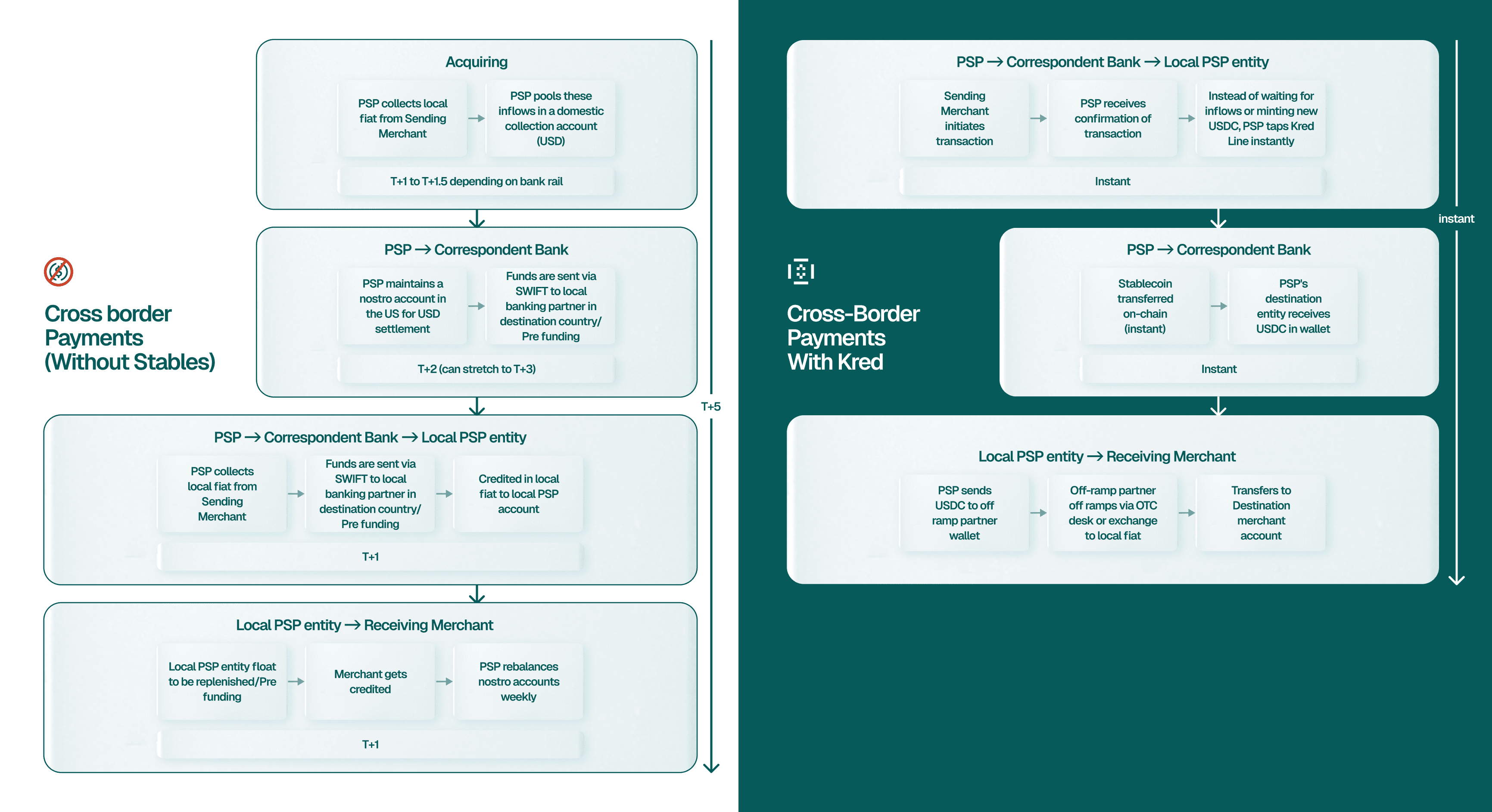

Cross-border payments today are slow because the system was designed around intermediaries, nostro accounts, and pre-funding. Even with stablecoins, PSPs still wait for inflows or minting cycles before they can move money.

Kred changes this.

It introduces real-time, programmable credit before inflows arrive. Eliminating the need to wait, pre-fund, or lock float.

Below is how the entire payment flow:

1. Traditional Cross-Border Payments (Without Stables)

(T+2 to T+5 end-to-end)

This system runs on SWIFT, nostro accounts, and pre-funded liquidity buffers.

PSP collects funds in local fiat from the sending merchant

Inflows are pooled and settled into a domestic USD account

Funds are sent to a correspondent bank in another country (T+2 or longer)

Local PSP receives funds and re-funds local float

Merchant finally gets credited

Every step is sequential.

Every step locks liquidity.

2. Cross-Border Payments With Kred

(Truly real-time end-to-end)

This is where the payment flow becomes instant + capital-efficient.

PSP receives transaction confirmation

Instead of waiting for inflows or minting USDC, PSP taps a Kred line instantly

Stablecoins move to the destination PSP instantly

Off-ramp converts to local fiat

Merchant is credited

The key unlock:

Kred provides just-in-time credit so PSPs no longer wait for inflows, settlement windows, or minting cycles. Liquidity becomes on-demand, not pre-funded.

Why This Matters

Before Kred

Pre-funding, nostro buffers, SWIFT delays, settlement cycles → capital locked for days.

After Kred

Credit is available the moment a transaction is initiated

PSPs can operate with near-zero pre-funding

Cross-border settlement becomes a real-time system

Treasury ops become simpler, cheaper, and more efficient

End customers experience dramatically faster payouts

Kred goes beyond improving on-chain settlement speed by removing the operational waiting layers that traditionally precede and follow it.

Built for Real Use Cases

Kred is designed for institutions moving real money, every day:

Remittances → Live corridor liquidity

Brokerage & fintech settlements → Eliminate pre-funding delays

Payroll → Pay on time without locking capital early

Card pre-funding → Reduce float without increasing risk

Trade finance → Real-time credit backed by repayment flows

In every case, Kred reduces waiting and unlocks working capital.

Kred imagines a world where:

capital is never idle,

credit is instant,

and liquidity becomes programmable.

A world where stablecoins do more than stay stable, they work.

Kred is the first step toward this future:

A financial infrastructure built for global institutions and global builders.

Finance has been stuck in neutral for decades. Kred shifts it into real-time.

Sign up for more interesting blogs & updates