Kelp

DeFi has solved a lot of things.

We can mint dollars on-chain, swap globally, borrow instantly, and route capital without banks.

But there’s one thing DeFi still mostly doesn’t do:

Fund real-world short-term credit demand at scale.

Not “RWA rewards” in the passive sense.

Not long-duration loans.

Not undercollateralized lending.

We mean the high-frequency, self-liquidating, massive credit that makes global payments work.

Kred is built to bridge that gap.

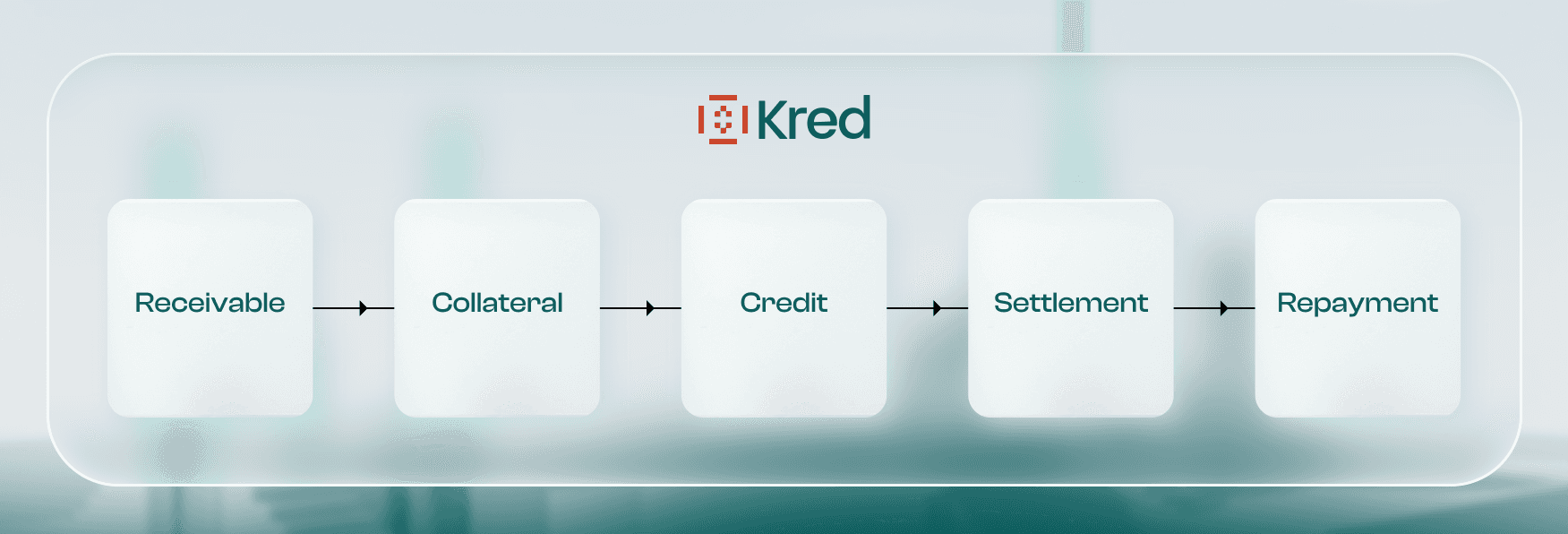

It connects DeFi stablecoin capital to real world credit demand, using a clean flow:

Receivable → Collateral → Credit → Settlement → Repayment

And it introduces a new primitive that DeFi doesn’t have today:

Internet of credit

Instant, secure Credit that exists because settlement is delayed and gets repaid when the settlement completes.

If you’ve ever wondered why $200T+ in annual payment flows still requires trillions of dollars parked as idle float, this is the missing layer.

Let’s break it down.

DeFi has Liquidity. No Destination.

DeFi has capital.

Stablecoin TVL is huge. Liquidity is deep.

But most of it ends up in one of two places:

Speculative loops (leverage, perp funding, basis trades)

Crypto-native lending (overcollateralized, vol-linked, reflexive)

Both are fine but structurally correlated to crypto markets.

Meanwhile, outside DeFi, global finance has the opposite problem:

settlement takes time

payments need liquidity immediately

so the system forces institutions to pre-fund and lock capital everywhere

This is why payment companies and remitters sit on giant idle balances.

Settlement is delayed and liquidity must be instant.

That’s the real liquidity gap.

And it’s massive.

PayFi needs: Credit against payment settlement receivables (short, fast-moving)

TradFi needs: Credit against commercial transaction receivables (longer, business operations)

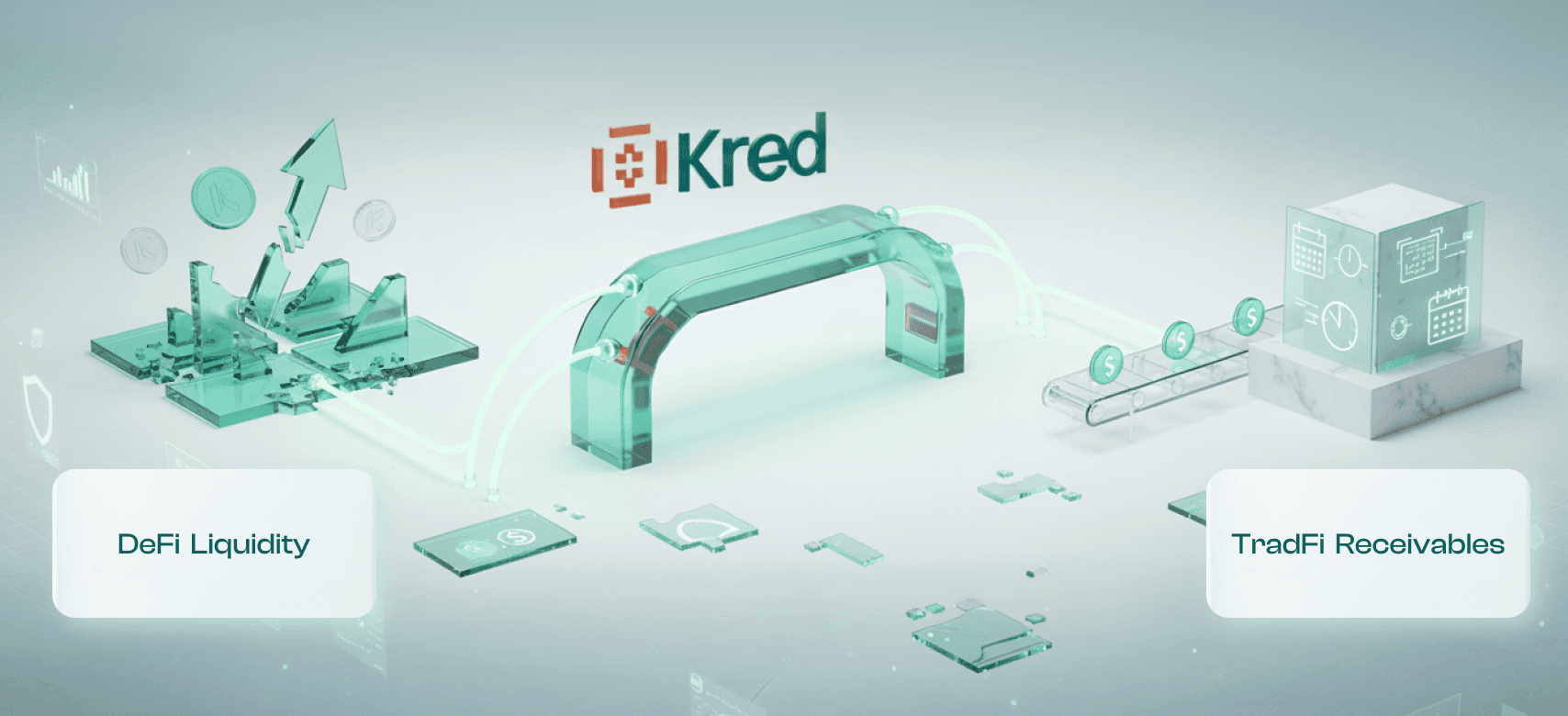

What DeFi Has: Liquidity

What Kred Adds: The Bridge

Kred serves two massive markets:

PayFi Credit (settlement-driven)

Payment processors waiting for card network settlement

Remittance companies bridging cross-border timing gaps

Treasury desks covering FX conversion delays

Duration: 1-7 days | Driver: Payment flows already in motion

TradFi Credit (transaction-driven)

Trade finance operators funding invoice cycles

Marketplaces managing vendor payout timing

Commerce platforms bridging purchase-to-settlement gaps

Duration: 7-90 days | Driver: Business operational needs

Both need the same thing: short-term, self-liquidating credit backed by real receivables.

Both create the same opportunity: predictable future payments that need liquidity now.

That's what Kred underwrites.

TradFi receivables become structured collateral

DeFi liquidity becomes just-in-time settlement credit

Repayment happens when settlement finalizes

The Kred Flow

1) Receivable

Borrowers are KYB-verified institutions (PSPs, remitters, marketplaces, treasury desks, trade finance operators, etc.).

They have a known pattern:

“We pay out now, we get settled later.”

That “settled later” is the receivable.

These aren’t degens borrowing against vibes.

They’re businesses with predictable transaction-backed flows.

2) Collateral

Kred doesn’t just “trust” receivables. It structures them into enforceable collateral:

borrower verification (KYB’d)

credit limits based on flow history

collateral terms & risk buffers

monitoring + repayment enforcement

This is a critical difference from generic “RWA rewards.”

Kred isn’t buying a long-duration asset.

It’s underwriting short-duration settlement credit.

3) Credit

DeFi LPs deposit stablecoins → mint KUSD.

That pool of stablecoins becomes the liquidity source.

Borrowers draw liquidity as credit — only when needed.

So instead of:

Locking capital in prefunded accounts

Maintaining dozens of corridor balances

Sitting on idle float

Borrowers get:

On-demand stablecoin liquidity

With transparent pricing and limits

Sourced from LP deposits

Where KUSD and sKUSD fit

KUSD is the on-chain representation of depositor capital + credit issuance

sKUSD is the staking layer for DeFi users who want to earn the repayment-driven rewards

LPs can hold KUSD, or stake it into sKUSD to earn rewards from borrower repayments.

4) Settlement → Powering real payment flows)

Borrowers use the stablecoin liquidity sourced from LP deposits to bridge real-world settlement obligations such as:

Merchant payouts

Remittance corridor payouts

Intraday FX liquidity needs

Payout platform obligations

Trade receivable cycles

So the core idea is:

DeFi stablecoins provide the liquidity upfront → Borrowers repay when payments settle → Liquidity gets recycled

This is what makes Kred the Internet of Credit: it exists because settlement is delayed, and it's consumed inside payment workflows.

5) Repayment → Rewards via sKUSD

The most important part:

Repayment is embedded in the same settlement cycle.

When card networks settle, invoices clear, or payout rails finalize, the receivable resolves.

That resolved settlement becomes repayment + interest.

This means credit is:

short duration

self-liquidating

high turnover

recycled repeatedly

How sKUSD generates rewards

Borrower repayments with interest are what generate rewards for sKUSD holders:

Borrowers repay principal + interest into the system

That interest is the real reward source

sKUSD represents staked KUSD earning these repayment cashflows

This packaging makes repayment-driven rewards composable inside DeFi

Kred the missing credit layer

If stablecoins were the breakthrough for transferring value, the next breakthrough is transferring liquidity where it's needed, when it's needed, under predictable rules.

That requires credit.

Kred bridges real-world credit demand with DeFi liquidity by:

Packaging receivables (from payments, settlements, and commerce) into enforceable collateral

Issuing on-demand credit matched to business cycles

Recycling DeFi stablecoin liquidity through real repayments

This isn't DeFi lending rebranded. It's not TradFi credit moved onto a blockchain.

It's a new primitive:

The Internet of Credit — where real-world receivables meet instant on-chain liquidity.

Sign up for more interesting blogs & updates