Kelp

KUSD does not earn rewards because markets go up.

It earns rewards because payments settle.

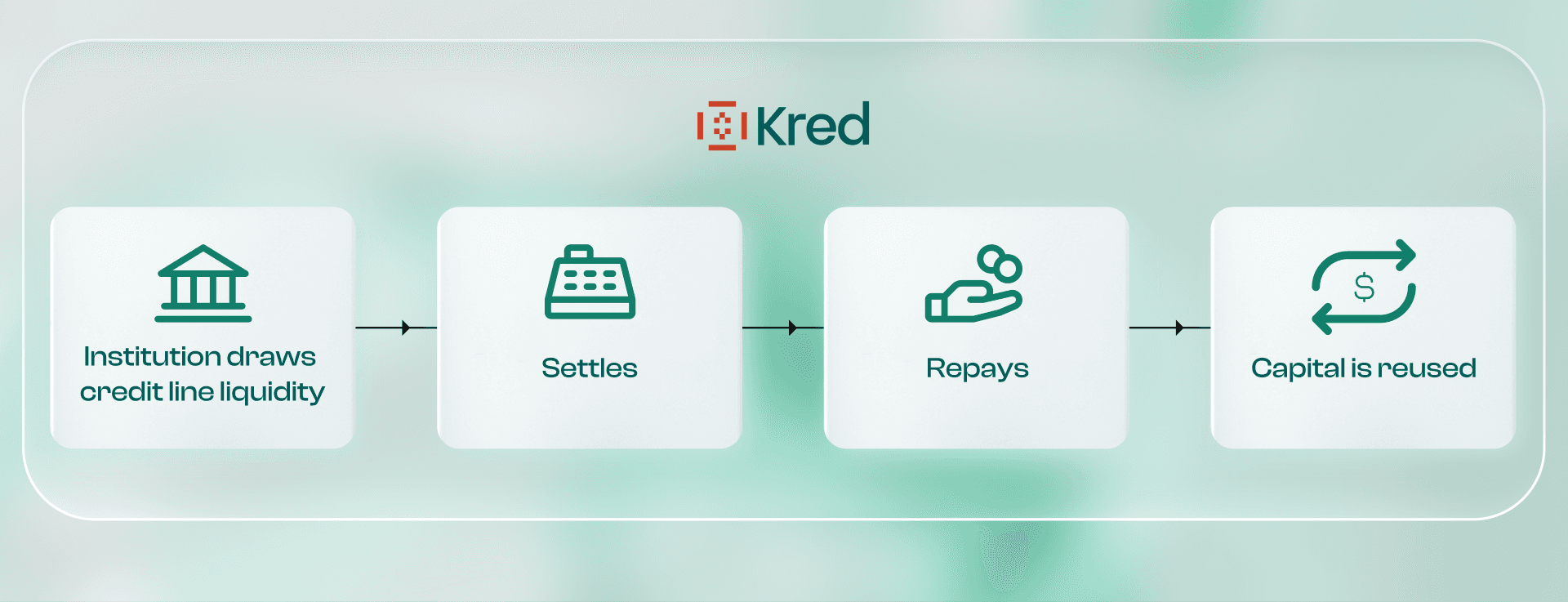

Most on-chain rewards are tied to market conditions or incentives. KUSD rewards are tied to settlement activity so the right way to understand it is the loop below:

Institution draws credit line liquidity → Settles → Repays → Capital is reused

KUSD sits directly on top of this cycle and sKUSD is staked KUSD that earns automated rewards.

No leverage.

No emissions-driven incentives.

No speculative reflexivity.

Just short-term credit doing real work, repeatedly.

The Real Bottleneck in Global Payments

Modern finance looks instant, but settlement still runs on buffers and pre-funding. In 2023, the payments industry processed ~3.4T transactions worth ~$1.8 quadrillion.

Source - McKinsey & Company

Cross-border flows alone approached ~$1 quadrillion in 2024.

Pre-funding is mandatory: money gets parked before settlement happens.

Cross-border: more intermediaries + more delays = bigger buffers.

Result: massive liquidity sits idle simply to keep payments flowing.

Kred’s role is to replace “idle buffers” with on-demand settlement liquidity that can earn rewards.

Step 1: Liquidity Becomes KUSD

When liquidity providers deposit USDC or USDT, they receive KUSD as a 1:1 receipt token representing their claim on the underlying capital.

At this stage, the capital characteristics change fundamentally:

• It is no longer exposed to crypto market price movements

• It is no longer speculating on market direction

• It is allocated for deployment into short-term settlement credit

KUSD represents a claim on capital that will be continuously deployed into real payment flows. The underlying stablecoins don’t sit idle—they’re ready to be matched with verified businesses needing settlement liquidity.

Step 2: KUSD Becomes sKUSD (The Rewards Layer)

KUSD can be staked into sKUSD, which is where the rewards mechanism activates.

sKUSD serves two functions:

1. Rewards accrual: As deployed liquidity is repaid through settlement cycles, the interest earned flows to sKUSD holders

2. DeFi composability: sKUSD is an ERC-20 token that can be used across DeFi protocols while still earning from underlying credit activity

The separation between KUSD (receipt) and sKUSD (rewards-earning) creates a flexible structure: KUSD remains liquid and transferable, while sKUSD captures the economic value generated by the credit infrastructure.

Step 3: A Payment Business Draws Liquidity

KYB-verified institutions like PSPs, remitters, FX desks, marketplaces, draw liquidity when they need to settle transactions.

Key characteristics:

Drawn only when required

Used for minutes, hours, or days

Bound by transparent credit limits and terms

Think of it as just-in-time settlement liquidity: drawn when needed, repaid as transactions settle.

Step 4: Real Transactions Settle

Once deployed, that liquidity enables:

Customer payouts

Cross-border transfers

FX conversions

Invoice and trade settlements

This is where value is actually created.

Rewards are generated by transaction completion and settlement.

As payments settle:

Fees are earned

Receivables clear

Cash flows resolve

The credit is self-liquidating.

Step 5: Borrowers Repay → sKUSD Earns Rewards

As settlements complete, borrowers repay:

Principal

Plus a predefined interest rate

Those rewards flow directly to sKUSD holders.

There’s no dependency on:

Market sentiment

Token appreciation

Continuous refinancing

Repayment is driven by settlement finality, not speculation.

Step 6: The Same Capital Is Reused

This is the compounding engine behind sKUSD.

Once repaid:

Capital is immediately available again

It can fund the next settlement cycle

Often multiple times per week

This liquidity can support many real-world transactions per year.

Rewards are generated by capital velocity, not long lockups.

Why sKUSD Is Not a Speculative Rewards Product

sKUSD does not rely on:

Emissions

Leverage

Liquidity mining

Market reflexivity

If payment volume exists, rewards exist.

If settlements happen, value accrues.

The system scales with:

Global payment flows

Cross-border commerce

Trade and settlement velocity

Not with crypto market cycles.

KUSD = High Rewards-bearing Stablecoin

sKUSD = Settlement-Native Rewards

sKUSD is best understood as settlement-native rewards, not DeFi rewards generating from real-world financial activities.

It replaces:

Idle pre-funded accounts

Nostro buffers

Expensive short-term bank credit

With:

On-demand liquidity

Transparent on-chain rules

Short-duration, self-liquidating exposure

For liquidity providers, this means:

Capital is always working

Rewards come from real economic activity

Risk is tied to duration and settlement. Not speculation

The Core Insight

KUSD earns from within the payment loop through sKUSD

Capital → enables settlement → gets repaid → gets reused

Over and over again.

That’s where the rewards come from. That’s why they’re durable.

Sign up for more interesting blogs & updates